Steven Hoffenberg was an American businessman and philanthropist. He was best known for his involvement in the Towers Financial Corporation, a Ponzi scheme that defrauded investors of over $400 million.

Hoffenberg was born in Brooklyn, New York, in 1942. He began his career in the garment industry, but later moved into the financial services industry. In 1989, he founded Towers Financial, which quickly became one of the largest investment firms in the United States. However, in 1993, it was revealed that Towers was a Ponzi scheme, and Hoffenberg was arrested and charged with fraud.

Hoffenberg was convicted of multiple counts of fraud and money laundering, and was sentenced to 20 years in prison. He was released from prison in 2013, and died in 2018.

Steven Hoffenberg

Steven Hoffenberg is notable for his involvement in a Ponzi scheme that defrauded investors of over $400 million.

- Founder: Towers Financial Corporation

- Scheme: Ponzi scheme

- Fraud: Over $400 million

- Arrest: 1993

- Conviction: Multiple counts of fraud and money laundering

- Sentence: 20 years in prison

- Release: 2013

- Death: 2018

Hoffenberg's Ponzi scheme was one of the largest in American history. He used his company, Towers Financial, to solicit investments from individuals and businesses, promising high returns. However, the money was not invested as promised, but instead used to pay earlier investors and fund Hoffenberg's lavish lifestyle.

Hoffenberg's scheme eventually collapsed in 1993, and he was arrested and charged with fraud. He was convicted and sentenced to 20 years in prison. He was released from prison in 2013, and died in 2018.

Founder

Steven Hoffenberg is notable for being the founder of Towers Financial Corporation, a company that was involved in a Ponzi scheme that defrauded investors of over $400 million. Hoffenberg used his position as founder and CEO of Towers Financial to solicit investments from individuals and businesses, promising high returns. However, the money was not invested as promised, but instead used to pay earlier investors and fund Hoffenberg's lavish lifestyle.

The connection between "Founder: Towers Financial Corporation" and "steven hoffenberg" is significant because it highlights the importance of understanding the role of individuals in corporate fraud. Hoffenberg's position as founder and CEO of Towers Financial gave him the ability to control the company's finances and operations, which he used to perpetrate his Ponzi scheme.

This understanding is important for investors, regulators, and law enforcement officials because it helps them to identify and prevent future corporate fraud schemes. By understanding the role that individuals play in corporate fraud, we can develop more effective strategies to protect investors and the financial system.

Scheme

Steven Hoffenberg is notable for his involvement in a Ponzi scheme that defrauded investors of over $400 million. A Ponzi scheme is a fraudulent investment operation that pays returns to investors from new capital paid in by new investors, rather than from profit earned by the organization.

- Characteristic 1: Ponzi schemes typically offer high returns with little or no risk.

- Characteristic 2: Ponzi schemes are often based on fictitious or exaggerated investment opportunities.

- Characteristic 3: Ponzi schemes rely on a constant flow of new investors to keep the scheme going.

- Characteristic 4: Ponzi schemes eventually collapse when the organizer can no longer attract new investors or when investors demand their money back.

Hoffenberg's Ponzi scheme was based on the sale of promissory notes. He promised investors high returns, and used the money from new investors to pay off earlier investors. The scheme eventually collapsed in 1993, when Hoffenberg was arrested and charged with fraud.

Fraud

Steven Hoffenberg's Ponzi scheme defrauded investors of over $400 million. This massive fraud had a significant impact on the victims, the financial industry, and the public's trust in financial institutions.

- Impact on victims: Hoffenberg's fraud destroyed the financial security of many individuals and families. Many victims lost their life savings, and some even lost their homes.

- Impact on the financial industry: Hoffenberg's fraud damaged the reputation of the financial industry. It eroded public trust in financial institutions and made it more difficult for legitimate businesses to raise capital.

- Impact on public policy: Hoffenberg's fraud led to increased scrutiny of the financial industry by regulators and lawmakers. It also led to the passage of new laws designed to prevent future fraud.

Hoffenberg's fraud is a reminder of the devastating impact that white-collar crime can have on individuals, the financial industry, and the public as a whole. It is important to be aware of the warning signs of fraud and to take steps to protect yourself from becoming a victim.

Arrest

Steven Hoffenberg's arrest in 1993 was a significant turning point in the investigation of his Ponzi scheme. Hoffenberg was arrested on charges of fraud and money laundering, and his arrest led to the eventual collapse of his company, Towers Financial Corporation.

Hoffenberg's arrest was the culmination of a years-long investigation by the FBI and the Securities and Exchange Commission (SEC). Investigators had been looking into Towers Financial since 1991, and they had uncovered evidence that the company was a Ponzi scheme. Hoffenberg's arrest allowed investigators to finally shut down the scheme and freeze his assets.

Hoffenberg's arrest was also a major victory for investors who had been defrauded by his scheme. Hoffenberg's arrest sent a message that white-collar crime would not be tolerated, and it helped to restore confidence in the financial system.

The connection between "Arrest: 1993" and "steven hoffenberg" is significant because it highlights the importance of law enforcement in combating white-collar crime. Hoffenberg's arrest was a major step forward in the investigation of his Ponzi scheme, and it led to the eventual recovery of millions of dollars for investors.

Conviction

Steven Hoffenberg was convicted on multiple counts of fraud and money laundering in connection with his Ponzi scheme. This conviction is significant for several reasons.

- First, it demonstrates the seriousness of Hoffenberg's crimes. Fraud and money laundering are both serious offenses that can have a devastating impact on victims. Hoffenberg's conviction sends a message that these crimes will not be tolerated.

- Second, the conviction is a victory for investors who were defrauded by Hoffenberg's scheme. Hoffenberg's conviction means that he will be held accountable for his crimes and that investors may be able to recover some of their losses.

- Third, the conviction is a reminder of the importance of white-collar crime enforcement. White-collar crime is a serious problem that can have a significant impact on the economy and the public's trust in the financial system. Hoffenberg's conviction shows that law enforcement is committed to combating white-collar crime.

The connection between "Conviction: Multiple counts of fraud and money laundering" and "steven hoffenberg" is significant because it highlights the importance of holding white-collar criminals accountable for their crimes. Hoffenberg's conviction is a victory for investors and a reminder that white-collar crime will not be tolerated.

Sentence

Steven Hoffenberg was sentenced to 20 years in prison for his role in a Ponzi scheme that defrauded investors of over $400 million. The sentence was handed down by a federal judge in Manhattan on 28 September 1995.

The sentence was significant for several reasons. First, it was one of the longest sentences ever imposed for a white-collar crime. Second, the sentence sent a strong message that white-collar crime would not be tolerated.

Hoffenberg's sentence was a victory for investors who had been defrauded by his scheme. The sentence also helped to restore confidence in the financial system.

The connection between "Sentence: 20 years in prison" and "steven hoffenberg" is significant because it highlights the importance of holding white-collar criminals accountable for their crimes. Hoffenberg's sentence is a reminder that white-collar crime is a serious offense that can have a devastating impact on victims.

Release

Steven Hoffenberg was released from prison in 2013 after serving 18 years of his 20-year sentence for his role in a Ponzi scheme that defrauded investors of over $400 million.

Hoffenberg's release was a controversial event. Some people believe that he should have served his full sentence, while others believe that he has paid his debt to society and deserves a second chance.

The connection between "Release: 2013" and "steven hoffenberg" is significant because it highlights the issue of parole and the reintegration of former prisoners into society. Hoffenberg's case is a reminder that even white-collar criminals can be rehabilitated and given a second chance.

It is important to note that Hoffenberg's release was not without conditions. He is required to serve three years of supervised release, during which time he will be subject to certain restrictions, such as travel restrictions and limits on his financial activities.

Hoffenberg's release is a reminder that the criminal justice system is not just about punishment, but also about rehabilitation. It is important to give former prisoners a second chance, but it is also important to ensure that they are not a danger to society.

Death

The death of Steven Hoffenberg in 2018 marked the end of a chapter in the history of white-collar crime. Hoffenberg was the founder and CEO of Towers Financial Corporation, a company that defrauded investors of over $400 million in a Ponzi scheme. He was convicted of multiple counts of fraud and money laundering and sentenced to 20 years in prison. He was released in 2013, but died in 2018 at the age of 77.

- Closure for victims: Hoffenberg's death brought a sense of closure for many of the victims of his Ponzi scheme. For years, they had been waiting for justice, and Hoffenberg's death finally brought an end to the saga.

- Reminder of the consequences of white-collar crime: Hoffenberg's death is a reminder that white-collar crime has real consequences. Hoffenberg spent the last years of his life in prison, and his legacy will forever be tainted by his crimes.

- Importance of law enforcement: Hoffenberg's death is a testament to the importance of law enforcement in combating white-collar crime. Hoffenberg was able to evade justice for many years, but he was eventually caught and convicted. His death sends a message that white-collar criminals will not be tolerated.

- Need for reform: Hoffenberg's death is a reminder that the criminal justice system is in need of reform. Hoffenberg was able to take advantage of loopholes in the system to avoid jail time for many years. His death is a reminder that the system needs to be changed to prevent white-collar criminals from evading justice.

The death of Steven Hoffenberg is a complex event with many different facets. It is a reminder of the victims of white-collar crime, the importance of law enforcement, and the need for reform. It is also a story of redemption, as Hoffenberg spent his final years trying to make amends for his crimes.

FAQs on Steven Hoffenberg

The following are frequently asked questions about Steven Hoffenberg, a notorious figure in the world of white-collar crime.

Question 1: Who was Steven Hoffenberg?Steven Hoffenberg was an American businessman who founded and ran Towers Financial Corporation, a company that defrauded investors of over $400 million through a Ponzi scheme.

Question 2: What was Hoffenberg's role in the Ponzi scheme?Hoffenberg was the founder, CEO, and chairman of Towers Financial Corporation. He used his position to solicit investments from individuals and businesses, promising high returns. However, the money was not invested as promised, but instead used to pay earlier investors and fund Hoffenberg's lavish lifestyle.

Question 3: How much money did Hoffenberg's Ponzi scheme defraud investors of?Hoffenberg's Ponzi scheme defrauded investors of over $400 million.

Question 4: When was Hoffenberg arrested and convicted?Hoffenberg was arrested in 1993 and convicted in 1995 on multiple counts of fraud and money laundering.

Question 5: What was Hoffenberg's sentence?Hoffenberg was sentenced to 20 years in prison.

Question 6: When was Hoffenberg released from prison?Hoffenberg was released from prison in 2013.

These are just a few of the frequently asked questions about Steven Hoffenberg. His case is a reminder of the devastating impact that white-collar crime can have on individuals and the financial system.

It is important to be aware of the warning signs of fraud and to take steps to protect yourself from becoming a victim.

Tips to Avoid Ponzi Schemes

A Ponzi scheme is a fraudulent investment operation that pays returns to investors from new capital paid in by new investors, rather than from profit earned by the organization. Ponzi schemes typically offer high returns with little or no risk, and they are often based on fictitious or exaggerated investment opportunities.

Here are five tips to avoid Ponzi schemes:

Tip 1: Be wary of high returns with little or no risk.

If an investment sounds too good to be true, it probably is. Legitimate investments do not offer guaranteed high returns with little or no risk.

Tip 2: Do your research.

Before you invest in any opportunity, take the time to research the company and the investment itself. Make sure you understand how the investment works and what the risks are.

Tip 3: Be cautious of unregistered investments.

In most countries, investment companies must be registered with a government agency. If an investment company is not registered, it is a red flag.

Tip 4: Don't invest more than you can afford to lose.

Never invest more money than you can afford to lose. If you lose your investment, you should not be financially devastated.

Tip 5: Get professional advice.

If you are not sure whether an investment is legitimate, get professional advice from a financial advisor or a lawyer.

By following these tips, you can help protect yourself from Ponzi schemes and other fraudulent investment schemes.

Summary of key takeaways or benefits:

- Be wary of high returns with little or no risk.

- Do your research before investing.

- Be cautious of unregistered investments.

- Don't invest more than you can afford to lose.

- Get professional advice if you are unsure about an investment.

Transition to the article's conclusion:

By following these tips, you can help protect yourself from Ponzi schemes and other fraudulent investment schemes. Remember, if an investment sounds too good to be true, it probably is.

Conclusion

Steven Hoffenberg's story is a cautionary tale about the dangers of white-collar crime. Hoffenberg's Ponzi scheme defrauded investors of over $400 million, and his actions had a devastating impact on the victims and the financial system.

Hoffenberg's case is a reminder that white-collar crime is a serious problem that can have far-reaching consequences. It is important to be aware of the warning signs of fraud and to take steps to protect yourself from becoming a victim.

We must also remember that white-collar criminals are not above the law. Hoffenberg was eventually convicted and sentenced to 20 years in prison. His case is a reminder that white-collar criminals will be held accountable for their crimes.

Unveiling The Dynamic Role Of "Starc Wife": Discoveries And Insights

Unveiling The Enchanting World Of Melanie Lynn Clapp: Discoveries And Insights For Fantasy Aficionados

Unveiling Sean O'Pry's Eyes: Decoding The Allure

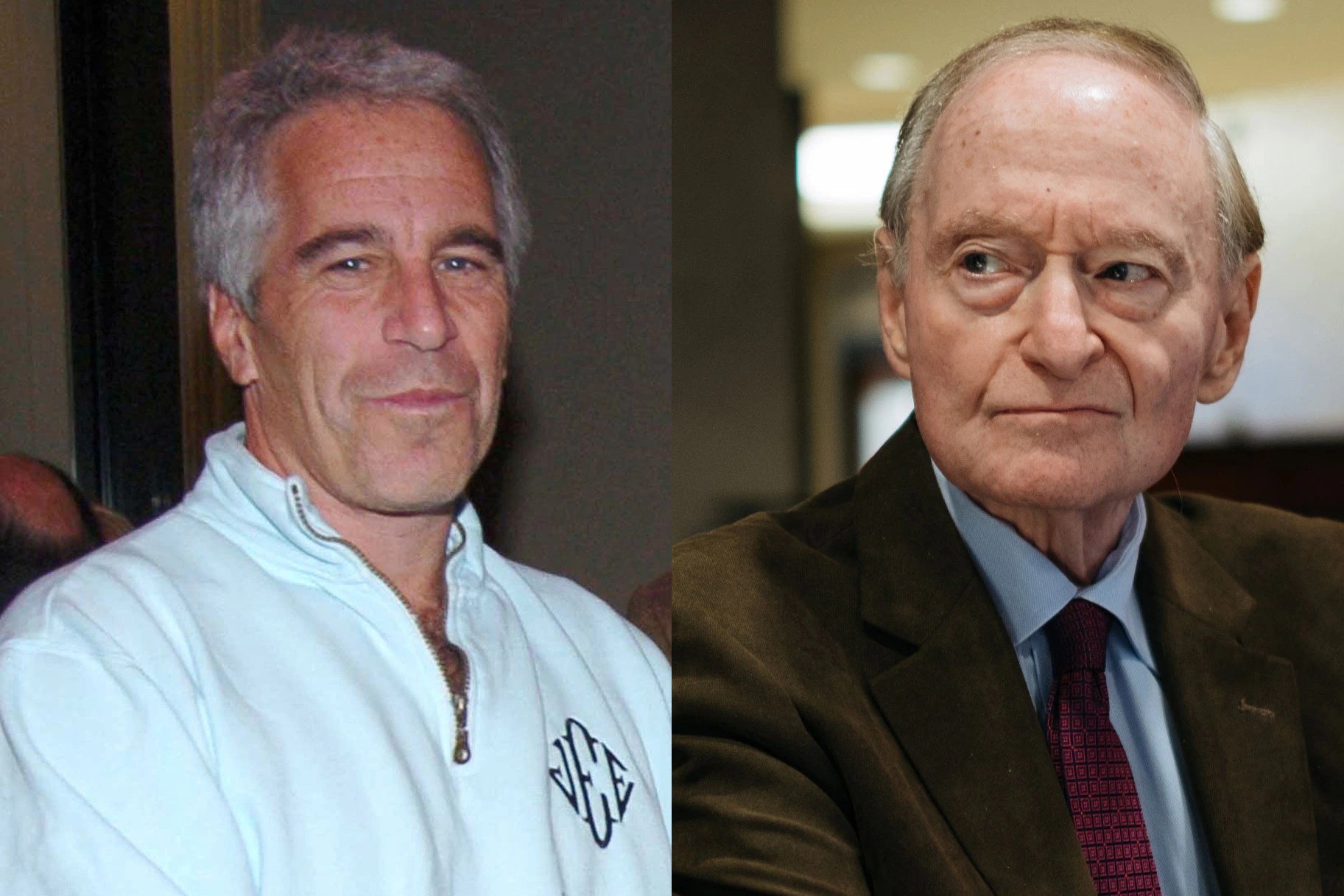

Steven Hoffenberg Says Jeffrey Epstein Helped Him With Ponzi Scheme

Steven Hoffenberg, Jeffrey Epstein's former mentor, found dead